On a recent cross-country flight, I made a pitstop in the restroom. On the way out, I was asked to rate my experience by pressing a button — one of four faces ranging from a happy smiley face to a red angry face. My selection was a quick, painless customer satisfaction survey.

Knowing what your customers think and feel makes all the difference when improving your user experience. So, what is a customer satisfaction survey, and what are the best practices for creating one?

![→ Free Download: 5 Customer Survey Templates [Access Now]](https://no-cache.hubspot.com/cta/default/53/9d36416b-3b0d-470c-a707-269296bb8683.png)

All fields are required.

.webp)

Click this link to access this resource at any time.

From my experience as a marketer, customer feedback is a goldmine of information on more than just satisfaction levels. When customers tell you what they like and don’t like about products or services, you’ll find out what you should definitely keep and what you might want to change.

For a real-world perspective, I talked to Amy Maret, HubSpot’s principal researcher for trends and thought leadership and a former market research manager. According to Maret, satisfaction surveys allow businesses to track their most important relationship — their relationship with customers.

“We see over and over that having an exceptional customer experience is absolutely critical to a business’s success, so being able to see in real-time how your customers are feeling, diagnose potential issues, and act quickly as soon as satisfaction starts trending down is a huge advantage to any organization,” Maret says.

I agree with Maret on the importance of customer relationships, and I think that you can strengthen your relationship by simply listening to customers.

If I don’t know why customers churn, I can’t do much to keep them — or win them back if they’ve already left. Essentially, I can’t know a customer’s thoughts if they don’t tell me.

Take my experience at a new coffee shop. I started going regularly until a barista told me that they had stopped serving oat milk. They offered alternatives, but I wasn’t interested and switched shops.

What’s the lesson? I’m not one to complain over minor things, but had I been given a customer satisfaction survey, I would have mentioned my milk issue.

Maret agrees that businesses should ask if customers are satisfied, but also why. In fact, Maret notes that the best surveys go beyond just measuring KPIs and actually identify which factors impact customer satisfaction.

“As soon as the business sees unsatisfied customers in their survey, they can go deeper into what exactly is causing that dissatisfaction and address those problems directly — which we know from our research leads directly to happier customers that are less likely to churn,” Maret says.

With a well-designed survey given at the right time, you can identify issues and resolve them, helping you increase customer loyalty.

If customers are genuinely happy with your product or service (and not just using it because they can’t find an alternative), they can become an extension of your marketing team — and they do it all for free!

When I moved to a new city, I asked around the office if anyone knew a good place for a haircut. Suddenly, everyone became an advocate for their hairdresser. I got information on everything I needed to know, including prices, personalities, and free extras, like top-tier snacks and drinks.

These recommendations were both honest and enthusiastic, and I found them more convincing than any paid marketing campaign.

If you can identify your brand advocates through customer surveys, you can show your appreciation for them and even incentivize their word-of-mouth marketin g.

When it comes down to making important business decisions, you need to get the input of all the important people in the room, and that includes your customers.

From a basic customer survey, I learned that something as simple as a new user interface for a website can annoy previously satisfied customers. As you might imagine, I held urgent discussions with my team to see how we could continue to satisfy loyal customers.

To show you how you can retain customers and have them shout your company’s benefits from the rooftops, I’ll share some customer satisfaction survey examples and templates.

Customer satisfaction surveys come in a few common forms, usually executed using a popular response scale methodology, like:

Each of these types of customer satisfaction surveys measures something slightly different, so it’s important to consider the specifics if you hope to use the data wisely.

.webp)

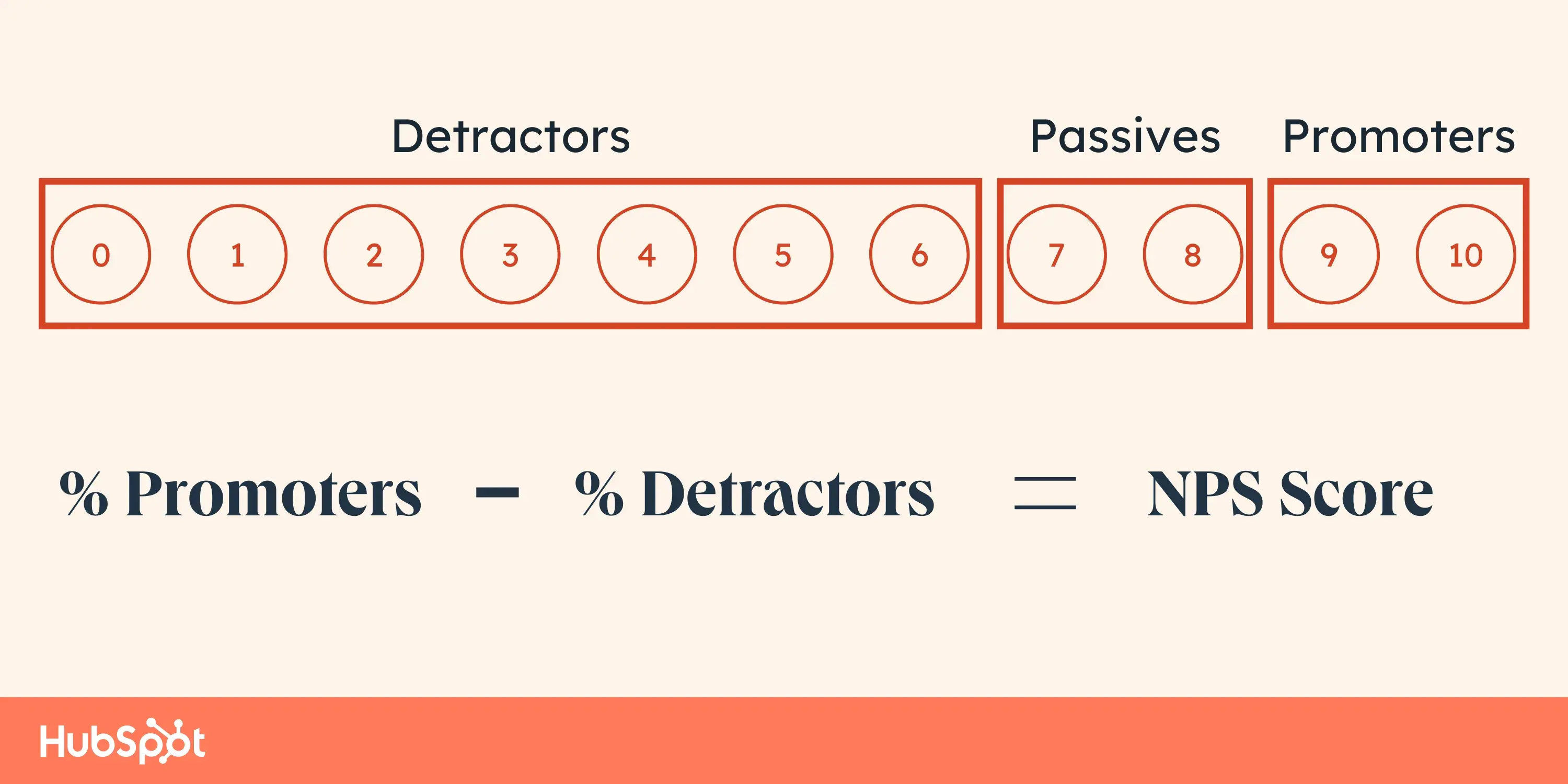

The NPS is a popular survey methodology, especially for those in the technology space.

It's rare to see a survey that doesn't use this famous question: “How likely is it that you would recommend this company to a friend or colleague?”

Ask your customers this question with HubSpot's customer feedback software.

Okay, you got me — this first example doesn’t technically ask customers about their level of satisfaction. But, I’ve found that customer satisfaction and willingness to recommend are often directly linked.

If I don’t like a new product/service, I won’t recommend it to friends. Sounds straightforward? Not exactly. When it comes to subjective experience and preferences, things can get a little tricky.

For example, if I watch a new movie that doesn’t appeal to me because it’s too quirky, I might still recommend it to a friend who loves that kind of thing.

So, how does this affect businesses? Well, if you build a great product, you might have a good NPS, even if not every potential customer can benefit from it.

Let’s look at how the NPS is measured:

On a rating scale of 0–10, your detractors score you 0–6, passives score you 7 or 8, and promoters score you 9 or 10. Your NPS score is your percentage of promoters minus your percentage of detractors.

For example, if 70% of my respondents are promoters and 20% are detractors, my NPS is +50. If you think +50 sounds disappointing, you might be surprised. According to market research firm B2B International, the average NPS for business-to-business (B2B) firms is +25 to +33.

.webp)

Easily measure customer satisfaction and begin to improve your customer experience.

All fields are required.

.webp)

Click this link to access this resource at any time.

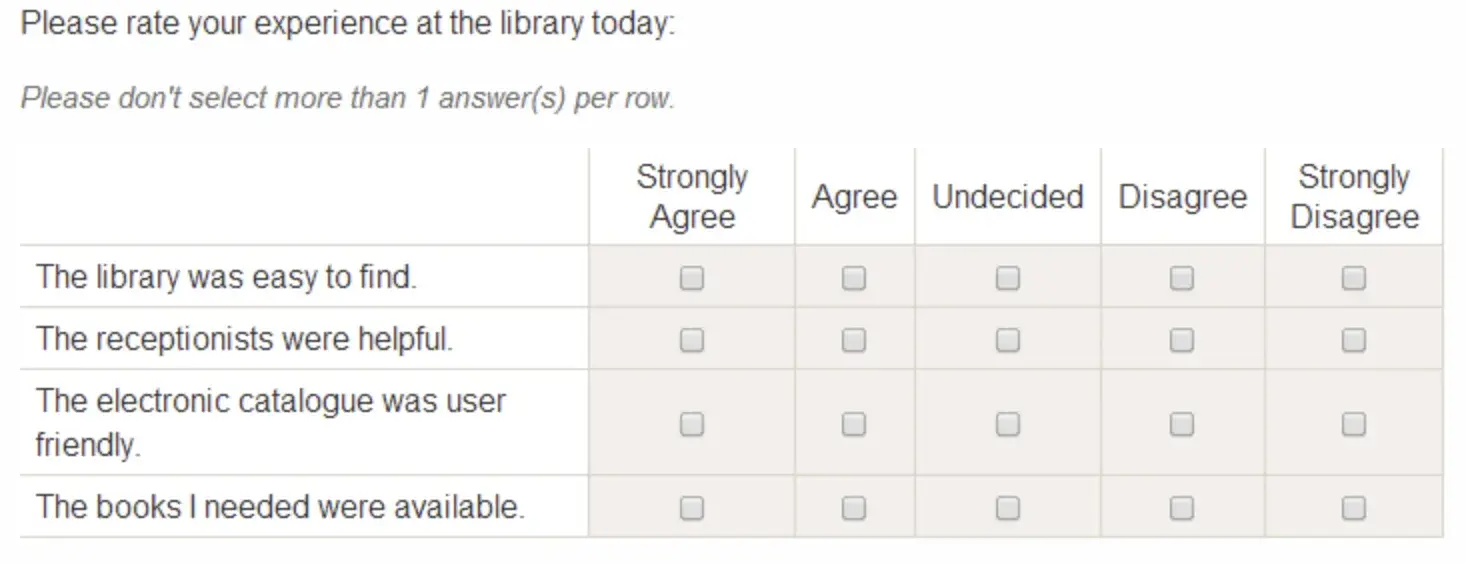

Many popular satisfaction surveys are based on scale questions. For example, the CSAT asks, “How satisfied are you with your experience?” and you rate the experience on a scale of 1 to 5 (a Likert scale).

You can design scale questions so that they’re answered using numbers (1-5), words (strongly agree), emojis (😀), and more.

Like other question types, they’re not without faults. For example, if I ask customers to rate my product and they give it a low score, I’m left guessing why exactly they gave me that score.

When to use: Use Likert scale questions and other scale types when you want a more specific response than a binary answer. They’re generally suitable if you don’t care too much about the reason behind a response.

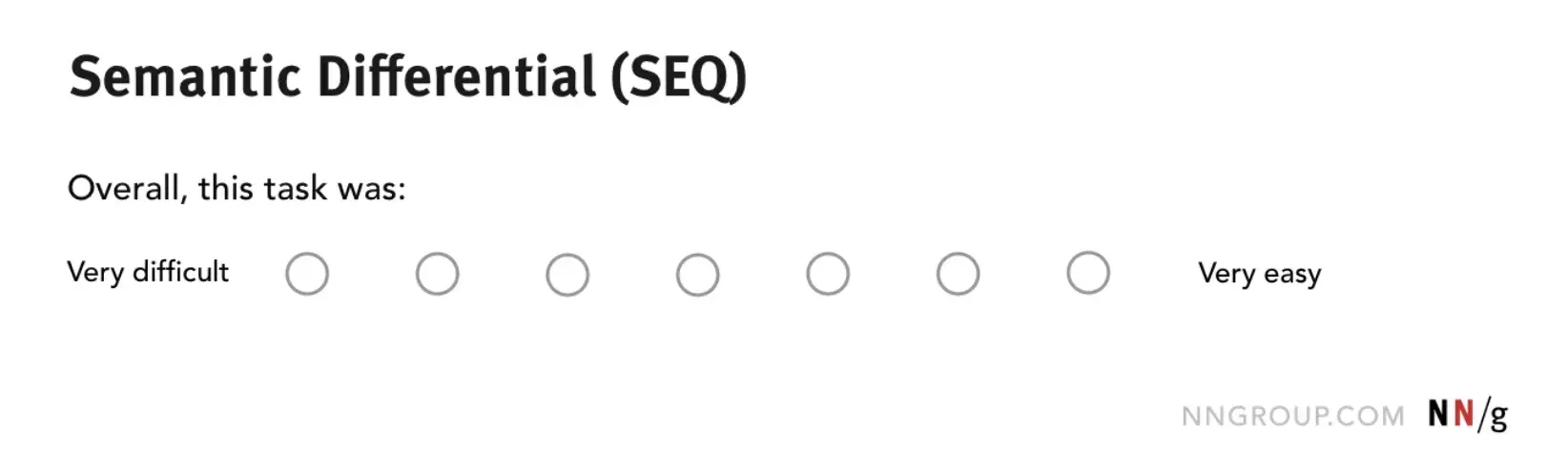

Similar to scale questions, semantic differential scales are based on binary statements, such as disagree and agree, but respondents can choose from a wide number of points between them.

That means customers don't have to pick just one or the other — they can choose a point between the two poles that reflects their experience accurately.

Here’s what a semantic differential question looks like in practice:

Say a website owner is testing out a new homepage design. So, they ask visitors a semantic differential question, “Do you like the new website design?” They let respondents answer using two extreme options of “I don’t like it” and “I like it” or multiple unlabelled options in between.

This can give the website owner a good handle on respondents’ actual perceptions of the new design, particularly if there are follow-up questions about specific design elements.

When to use: Use this type of question if you want respondents to be able to interpret the answer continuum as they see fit. This can help you find out their strength of satisfaction or dissatisfaction without introducing bias from labels like “neutral” or “somewhat satisfied.”

None of the surveys I’ve discussed above tell you the why of an experience — you only get the what. To find out the why, you need qualitative data, which you can get from this type of customer satisfaction survey question.

Maret notes that qualitative questions allow customers to tell you the real why behind their satisfaction, without you having to make assumptions about what matters to them.

“When you want to dig deeper into motivations and underlying factors, it is helpful to hear from customers in their own words. But be careful — too many open-ended questions in one survey can cause respondent fatigue — potentially frustrating your customers and damaging your data quality,” Maret says.

I’ll add to her warning with one of my own: Make sure you’re asking clear questions without letting your bias or expectations slip through.

For example, if you write, “Tell us, in your own words, why our products are so great,” you leave little room for collecting customer feedback that’s critical of your products, and that’s a missed opportunity.

In many of my surveys, I’ll add some open-ended questions to take an in-depth look at customer expectations, customer needs, and more. Often, the insights I get from open-ended questions are the most valuable, but it can take a lot of time and resources to mine these insights.

When to use: Use open-ended questions when you have the time to really dig deep into the answers.

You’ll often see this type of question at the end of a survey with multiple question types — I have found that it helps respondents share thoughts that aren’t covered in other questions.

To bring you closer to creating the most suitable customer satisfaction survey for your business, I’ve collected some tried-and-tested best practices for you to follow.

If you want quantitative data, I don’t recommend open-ended questions. But there’s nothing stopping you from having a mixed survey type to cover all your bases. If you go this route, I recommend a logical, consistent approach to keep readers on track.

For example, I find that open-ended questions work well at the end of a group of closed questions or as the final section of a survey.

Remember I said to be careful of your question phrasing? I meant it. Make sure you’re asking the right questions, which should be clear and free from bias.

If you measure customer sentiment at the right time, you’ll get actionable results — and a chance to make things right with customers before it’s too late. The correct stage will largely depend on your business type, but in general, you should send out surveys shortly after a purchase.

If you’ve lost a customer, an exit survey can tell you why. But if you spot signs of dissatisfaction and survey customers before they’ve left, you can make a real difference.

For example, I once got negative feedback from a customer just before they were about to switch to a competitor. When I told them I understood their concerns and would work with them to make things right, they appreciated feeling listened to and retained our services.

.webp)

Easily measure customer satisfaction and begin to improve your customer experience.