For several decades, central banks in advanced economies typically used a policy interest rate as their tool for conducting monetary policy. In response to the global financial crisis (GFC) of 2007–2009 and the deep recession it caused in parts of the world, central banks in many advanced economies lowered their policy interest rates to near-zero levels. As economic growth remained weak, interest rates persisted at near-zero levels and some central banks used ‘unconventional’ monetary policy to stimulate economic activity. (See Explainer: The Global Financial Crisis and the Deputy Governor's speech Lessons and Questions from the GFC for an explanation of the causes and consequences of the GFC.) These unconventional measures again became prominent as central banks around the world responded to the severe economic consequences of the coronavirus ( COVID-19 ) global pandemic.

This Explainer describes the difference between conventional and unconventional monetary policy. It also describes the different tools that have been used by central banks when conducting unconventional monetary policy, and summarises the tools used in Australia in response to the economic effects of the COVID-19 pandemic.

Conventional monetary policy has involved central banks changing a target for a short-term interest rate – their policy interest rate – to achieve their economic objectives. The policy interest rate influences other interest rates in the economy (such as interest rates for housing loans or business loans, and interest rates on savings accounts). Changes in these interest rates affect the cost of borrowing and the reward for saving, the exchange rate and the prices of some assets. This influences people's decisions to invest or consume, which ultimately affects economic activity. Consequently, by changing interest rates, conventional monetary policy helps a central bank achieve its goals for such things as aggregate demand, employment and inflation. Raising interest rates dampens growth in aggregate demand and employment and puts downward pressure on inflation. In contrast, lowering interest rates stimulates growth in aggregate demand and employment and puts upward pressure on inflation.

In Australia, the policy interest rate used for conventional monetary policy is the ‘cash rate’, with the Reserve Bank of Australia (RBA) changing the target for the cash rate to influence aggregate demand in a manner that is consistent with its inflation target and efforts to maintain full employment. (For more information in an Australian context see Explainer: What is Monetary Policy? and Explainer: The Transmission of Monetary Policy.)

Unconventional monetary policy occurs when tools other than changing a policy interest rate are used. These tools include:

With the exception of negative interest rates, these tools have always been in the ‘toolkit’ of central banks and have been used in some way by most central banks in the past, particularly to support the functioning of financial markets. [1] What has been unconventional in recent years is the use of these tools as the principal mechanism for achieving monetary policy goals.

Forward guidance relates to the central bank's communication of the ‘stance’ of monetary policy. It lets market participants and the general public know what the future path of the policy interest rate, and potentially other aspects of monetary policy, is likely to be. Forward guidance can be:

Under ‘time-based guidance’, the central bank commits to a stance of monetary policy until a specific point in time (e.g. it will not increase interest rates until a certain date). Under ‘state-based guidance’ , the central bank commits to a stance of monetary policy until a specific set of economic conditions are met (e.g. it will not increase interest rates until inflation or unemployment reach certain levels).

During episodes of crisis, like the GFC and the COVID-19 pandemic, central banks set low policy interest rates, attempted to lower interest rates generally and provided other specific measures to support the economy and financial system. They were also active in providing forward guidance. A primary motivation for their forward guidance was to reinforce the central bank's commitment to low interest rates, which helps reduce the interest rates people can expect in the future. A related motivation was to make clear how the central bank can be expected to react in unusual times. Generally, forward guidance has been helpful in reducing uncertainty about the economic and financial outlook.

Asset purchases involve the outright purchase of assets by the central bank from the private sector with the central bank paying for these assets by creating ‘central bank reserves’ (in Australia these are referred to as Exchange Settlement or ES balances). (Some people have referred to this as ‘printing money’, but the central bank does not actually print any banknotes to pay for the asset purchases.)

Asset purchases have long been a feature of central bank operations (and were once the main tool for influencing the policy interest rate). However, since the GFC and especially during the COVID-19 pandemic, asset purchases were used more extensively and led to a large expansion of central bank balance sheets. Furthermore, as part of their asset purchase programs, some central banks have bought a wide range of assets (whereas in the past, they bought only government bonds), though the main asset type has remained government bonds.

Typically, when a central bank undertakes asset purchases, it can either set a target for the quantity of assets it will purchase (at any price) or a target for the price of an asset (purchasing whatever quantity of assets will achieve that price); for a bond, the relevant price is its interest rate. A quantity target for asset purchases is also known as quantitative easing (QE).

The precise goal of asset purchases by the central bank has varied across countries, but a common theme has been the desire to lower interest rates on risk-free assets (such as government bonds) across different terms to maturity of those assets – that is, across the yield curve. [2] (See Box on ‘Government bonds and the risk-free yield curve’.) In this way, asset purchases by the central bank can lower a range of interest rates other than the policy interest rate (which may already be as low as it can practically go – i.e. be at its effective lower bound). Central bank asset purchases also reinforce the central bank's forward guidance that policy interest rates will remain low, adding to downward pressure on bond yields. In addition, investors can use the proceeds they receive from selling their assets to the central bank to purchase other assets. These portfolio adjustments by investors can affect the price of these other assets and the exchange rate.

Term funding facilities involve central banks providing low-cost, long-term funding to financial institutions at rates below the cost of most of their existing funding sources. Such facilities were used following the GFC and again more recently in response to the COVID-19 pandemic. Term funding facilities are useful when short-term interest rates are already very low, since they can help to lower the cost of longer-term funding for financial institutions. This helps to reduce interest rates for borrowers and support the supply of credit to the economy. Term funding facilities can also provide extra incentives to encourage financial institutions to lend to businesses and households.

In response to the GFC and later to the COVID-19 pandemic, many central banks made significant changes to their existing market operations to deal with strains in financial markets that were impairing the supply of credit to the economy. While the details differed between countries, the changes to operations have included central banks:

The purpose of these changes to market operations was to address the fact that in periods of financial stress (such as during the GFC and at the onset of COVID-19 pandemic) , financial institutions were very nervous about their access to liquidity. This, in turn, made them nervous about investing and lending, increasing the likelihood of a severe ‘credit crunch’ and economic contraction. By providing financial institutions with greater confidence about their access to liquidity, central banks have been able to support the supply of credit and ensure financial markets function smoothly.

Negative interest rates are truly unconventional. They are also difficult to imagine, as they imply that instead of earning interest on money deposited in a bank, people would be charged by their bank to deposit money. Prior to the GFC, it was widely thought that there was a ‘zero lower bound’ for the policy interest rate, meaning that it was thought interest rates could never be negative. This was because if interest rates were negative, people would simply choose to hold their savings as banknotes outside the banking system (‘cash under the mattress’) so that deposits would be unavailable to banks for lending or other purposes.

As it turned out, a zero lower bound did not prove to be a constraint. Policy interest rates became negative in several countries. However, commercial banks did not pass on negative policy interest rates and implement negative rates for all their customers – they judged that it did not make sense either commercially or politically to charge households and smaller businesses for holding their deposits. Nonetheless, there is still likely to be a lower bound. At some point depositors will withdraw money and hold banknotes, so central bankers began to talk about an ‘effective lower bound’ for policy interest rates rather than a zero lower bound.

While the GFC had motivated the introduction of unconventional monetary policies in various countries, Australia was less affected than other advanced economies; it was able to deal with that crisis by using the policy rate as its principal tool and providing adequate liquidity to the financial system – that is, it conducted conventional monetary policy.

However, the emergence of the COVID-19 pandemic became an economic event of extraordinary scale across the world. In response to the economic effects of COVID-19 pandemic, in March 2020, the RBA implemented unconventional monetary policy measures in Australia for the first time. In November 2020, the RBA announced further unconventional monetary policy measures to support the creation of jobs and the recovery of the Australian economy from COVID-19 pandemic. (For a one-page summary of the monetary policy response to the COVID-19 pandemic, see Illustrator: Monetary Policy and COVID-19 .)

Unconventional monetary policy in Australia includes some of the tools described in the previous section, complementing the RBA's longstanding approach to setting policy interest rates.

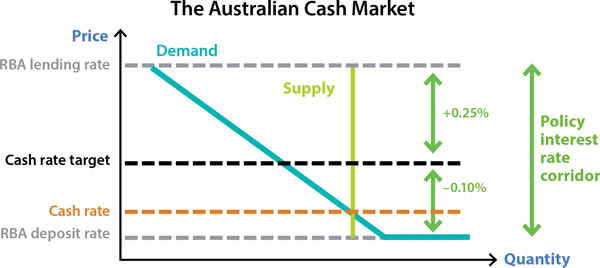

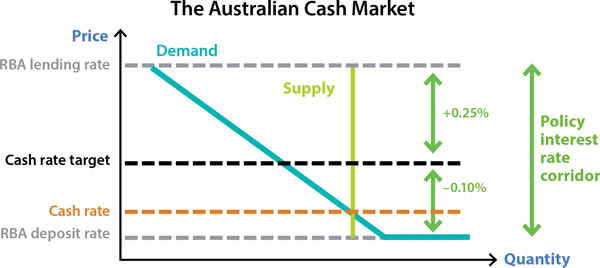

The cash rate target was reduced to 0.1 percentage points, its lowest ever rate. This motivated an adjustment to the policy interest rate ‘corridor’ system that had been used for conducting monetary policy in Australia over many years.

Banks have Exchange Settlement accounts with the RBA (to settle daily interbank transactions) where they can deposit and borrow funds. Under the corridor system that existed prior to COVID-19 pandemic, banks could deposit funds in their ES accounts at an interest rate 0.25 percentage points below the cash rate target (the floor of the corridor), or borrow funds to have in their ES accounts at an interest rate 0.25 percentage points above the cash rate target (the ceiling of the corridor). (See Explainer: How the Reserve Bank Implements Monetary Policy for an explanation of the policy interest rate corridor prior to COVID-19 pandemic.)

Under this system, a cash rate target of 0.1 per cent would mean the floor of the corridor became negative. Instead, the RBA made an adjustment to the corridor so that the interest rate paid on deposits in ES accounts was zero. Zero interest paid on balances in ES accounts puts a floor under the cash rate which in turn puts a floor under all interest rates in the economy. In other words, this adjustment narrowed the lower part of the corridor; there was no change to arrangements for the ceiling of the corridor. In addition, the supply of funds in ES accounts increased as a result of some unconventional monetary policies used by the RBA, such as asset purchases, the Term Funding Facility and adjusted market operations. The RBA chose to leave these ES balances in the banking system, which caused the cash rate to trade closer to the interest rate on ES balances (the RBA deposit rate in the chart) rather than at the cash rate target.

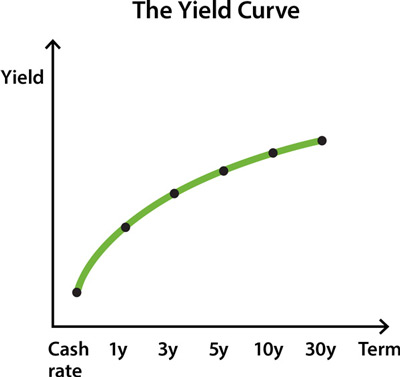

A program of asset purchases was undertaken to lower interest rates across the yield curve. In order to do this, the RBA purchased government bonds using a price target to influence the shorter part of the yield curve and a quantity target to lower the longer part of the yield curve.

The price target focused on the yield on the three-year Australian Government bond because, in addition to the cash rate, this interest rate is an important interest rate in financial markets that influences other interest rates in the economy. The RBA committed to purchasing whatever quantity of bonds was required to achieve the target. The target for the three-year yield was set to be the same as the target for the cash rate (at around 0.1 per cent).

The quantity target involved the RBA purchasing a large volume of government bonds issued by the Australian Government, and also the state and territory governments, around the 5- to 10-year term. These purchases were aimed at lowering interest rates at the longer part of the yield curve.

The RBA engaged in forward guidance. The Governor stated that the Reserve Bank Board would not raise the target for the cash rate until actual inflation was sustainably within the 2–3 per cent target range. For this to occur, the economy would have to see significant gains in employment so that wages growth would increase. Alongside this state-based forward guidance, the Bank provided a possible timeframe by which the required economic conditions might exist.

The RBA introduced a Term Funding Facility (TFF) for the banking system, which allows banks (and other authorised deposit-taking institutions) to borrow funding from the RBA at low cost. The TFF helped to reduce interest rates for borrowers and supported the banking system to supply credit to businesses and households. The interest rate available through the TFF was fixed for the term of the lending – three years – consistent with the forward guidance by the Bank and the price target for the three-year yield. Under the TFF, these lenders could borrow additional funds from the RBA if they increased the credit supplied to businesses, in particular small and medium-sized businesses.

During the crisis in financial markets in the early period of COVID-19 pandemic, the RBA significantly increased the size of its regular open market operations. The RBA later expanded the range of collateral it would accept in its market operations. Both of these measures helped to ensure that financial institutions had access to ample liquidity and helped financial markets to function smoothly.

The RBA also purchased government bonds issued by the Australian Government, and the state and territory governments, to help these important financial markets function smoothly. These purchases were separate to the bond purchases that were designed to lower the yield curve.

Unconventional monetary policy has the same goals as conventional monetary policy. It can lower interest rates further than is possible by adjustments to the policy interest rate alone (which may be at its effective lower bound). As with a lower cash rate, this reduces the cost of borrowing, puts downward pressure on the exchange rate and leads to higher prices for some assets than otherwise (which make it easier for people to borrow and increases their confidence to spend). Unconventional policy measures that provide liquidity to stressed financial markets also support financial stability. Using forward guidance reduces uncertainty about the future stance of monetary policy.

However, some argue that there are potential side effects of unconventional monetary policy, for example:

The COVID-19 pandemic triggered the largest peacetime contraction in the Australian economy since the Great Depression of the 1930s and required an unprecedented monetary policy response. The Reserve Bank Board committed to do what it could to support job creation, the recovery of the Australian economy and complement other arms of policy – in particular fiscal policy – in addressing the challenges presented by COVID-19 pandemic.

A government bond is a loan made by an investor to the government for a fixed period of time (called its ‘term’). Once issued, a bond can be traded with other investors in a financial market and has a market price. For an investor that has purchased a bond, the return they expect to receive each year over the term of the bond is called a ‘yield’. A bond's yield is expressed like a normal interest rate and moves in the opposite direction to its price (if a bond's price goes up, its yield goes down).

When a government bond is issued, an investor has purchased the bond from the government for the first time in a marketplace called the ‘primary market’. After the bond is issued, the investor can trade that bond with other investors in a ‘secondary market’, where the bond's yield may change with market conditions. Central banks almost always purchase bonds from financial institutions in the secondary market and so do not purchase bonds directly from the government.

The risk-free yield curve is a combination of the policy interest rate (an overnight interest rate) and the yields on government bonds over different terms. The expression ‘risk free’ is used because governments are not expected to fail to pay back the borrowing they have done by issuing bonds in their own currency. Some monetary policies work partly by influencing the level and slope of the yield curve. The yield curve is used as a guide for setting many interest rates in the economy, which is one way changes in monetary policy flow through to changes in a broad range of interest rates.

Negative rates are, however, not unprecedented. In the early 1970s the Swiss National Bank required banks to levy a –2 per cent rate on non-residents' Swiss franc accounts. [1]

When a central bank purchases bonds, it adds to demand for them and increases their price. As a result, their interest rate or yield falls. [2]

The materials on this webpage are subject to copyright and their use is subject to the terms and conditions set out in the Copyright and Disclaimer Notice. © Reserve Bank of Australia, 2001–2024. All rights reserved. The Reserve Bank of Australia acknowledges the Aboriginal and Torres Strait Islander Peoples of Australia as the Traditional Custodians of this land, and recognises their continuing connection to country. We pay our respects to their Elders, past and present. Aboriginal and Torres Strait Islander peoples should be aware that this website may contain the names, images and voices of people who are now deceased.