Financial regulators, international organizations, market participants and others have directed significant attention in recent years towards developing an understanding of the implications of climate change for the financial sector and financial stability. 1 Climate change-related financial risks pose both micro- and macroprudential concerns, but analysis and research is at an early stage. 2 This Note describes an approach to understanding how risks arising from climate change may affect financial stability, and connects this discussion to the financial stability monitoring framework described in the Federal Reserve's Financial Stability Reports. 3 That framework distinguishes between shocks to the financial system and economy, which are difficult to predict, and vulnerabilities, which are underlying features of an economic or financial system that can amplify the negative effects of shocks. We describe how climate-related risks may emerge both as shocks and as vulnerabilities that could amplify the effects of climate-change related shocks or other shocks. 4

This analysis offers a way to assess the financial stability impact of risks resulting from climate change as information on the nature, extent, and timing of those risks improves. Our approach to describing climate-related financial stability risks is complementary to, though both simpler and broader than, the existing international typology described in Carney (2015).

We offer three main conclusions. First, the Federal Reserve's financial stability monitoring framework is flexible enough to broadly incorporate many key elements of climate-related risks. Second, although we believe that climate change increases financial stability risks, more research and analysis is needed to incorporate these risks fully into financial stability monitoring, including substantial improvements in data and models. Third, domestic and international transparency efforts around climate-related financial exposures may help clarify the nature and scope of financial stability risks related to climate change.

At a broad level, climate change refers to changes in the usual conditions of nature of the Earth's oceans, fresh water, and atmosphere. 5 These changes include, for example, increases in average global temperatures, the frequency and severity of major storms, and the level or acidity of oceans, among many other effects. There is a strong scientific consensus that the global climate has already changed substantially over the past century and that future changes should be expected as human-caused emissions of greenhouse gases continue. Greenhouse gases in the Earth's atmosphere, such as carbon dioxide and methane, block solar radiation reflected from the Earth's surface, thereby raising global temperatures. The higher the concentration of these gases, the greater their effect on climate.

Despite the scientific consensus on trends in and causes of climate change, the exact timing and precise magnitudes of future climate outcomes remain uncertain. 6 We refer to this range of possible future physical outcomes arising from climate change as climate risks. Researchers continue to further develop and refine climate and econometric models that forecast the path of climate change, but much uncertainty remains.

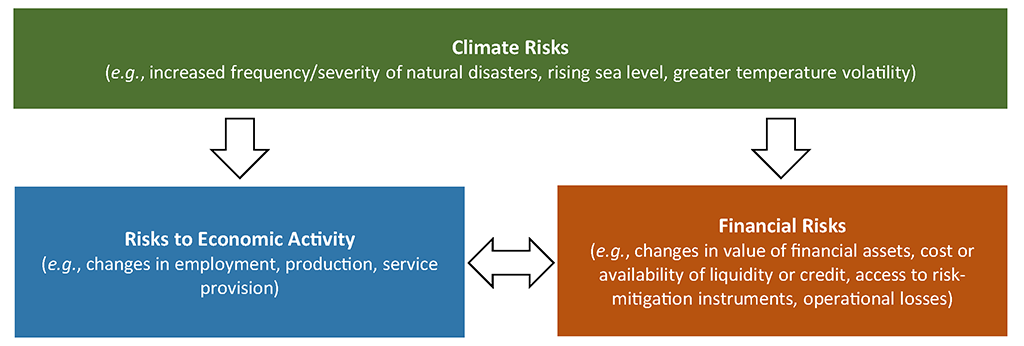

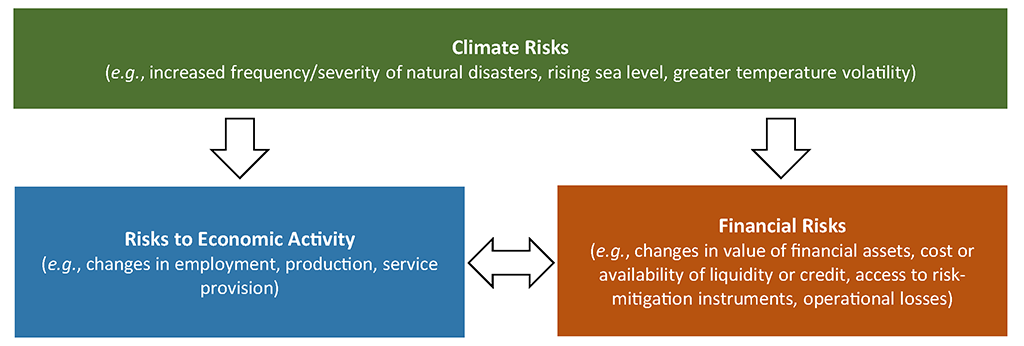

Projections of economic activity and the accompanying greenhouse gas emissions have long been an input into climate models that estimate these climate risks. 7 However, since the early work of Nordhaus in the 1970s, a growing body of research also treats economic activity as an output of these models, recognizing the effect that the climate has on economic and financial outcomes. 8 These effects occur through a climate damage function, which reflects deteriorating public health, labor productivity, and agricultural yields, failing public infrastructure, rising mortality rates, and weather-related property destruction among other impacts. 9 Such adverse effects can result in direct financial risks, prompting a reassessment of asset values, changing the cost or availability of credit, or affecting the timing or reliability of cash flows. They can also create risks to economic activity, which can themselves create or amplify financial risks. Economic and financial risks can also amplify one another—for example, weather-related property destruction can lead to bank losses, leading to less lending, leading to reduced investment, and so on. (See Fig. 1.)

By themselves, climate-related economic or financial risks need not affect financial stability; the economy can experience a decline in output, and investors can experience losses, without these effects being amplified by the financial system. Under some conditions, however, these risks could increase financial-system vulnerabilities through losses to levered financial intermediaries, disruption in financial market functioning, or sudden repricing of large classes of assets.

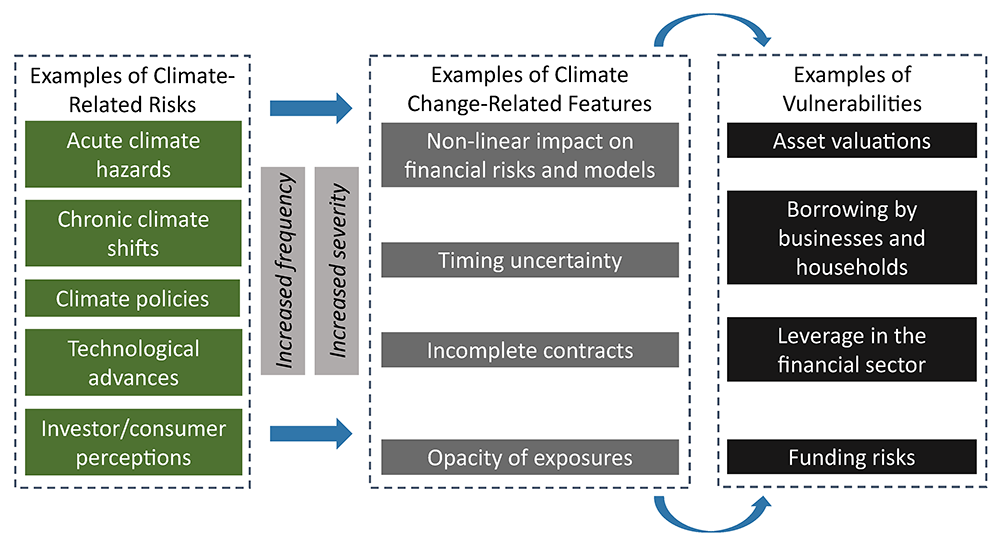

This cascade of consequences fits within the Federal Reserve's financial stability monitoring framework in two ways (see Fig. 2). First, climate risks can manifest as shocks to the financial system. 10 Acute hazards, such as storms, floods, or wildfires, can quickly change or reveal new information about future economic conditions or the value of real or financial assets. 11 With the potential for sudden large shifts in perceptions of risk, chronic hazards (like a slow increase in mean temperatures, or rising sea levels) could produce abrupt repricing events, if investor expectations or sentiment about the physical risks change abruptly. While these examples focus on physical risks, shocks to the financial system may emerge from a broader set of climate risks. These additional risks include the emergence of climate-related liability risks or future changes in climate policies. Like all financial shocks, it is difficult to predict how and when these broader set of climate risks may be realized as financial shocks.

Second, climate risks can also increase financial system vulnerabilities that could transmit and amplify shocks. The examples below illustrate features of climate change that increase the probability of asset mispricing and higher nonfinancial and financial leverage, which interconnectedness and reduced diversification could amplify:

Table 1 shows some illustrative examples of links between climate risks and financial stability risks. The risks described below may appear as combinations of vulnerabilities and shocks.

Real estate: Under many climate projections, climate change leads to a further rise in sea levels and increase in storm surge. 17 These effects, in turn, lead to increased inundation of coastal land parcels, which could either damage existing structures on those parcels, or require investment and adaptation for their continued productive use. 18 As this inundation occurs, the expected value of coastal real estate may decrease—which may, in turn, pose risks to real estate loans, mortgage-backed securities, the profitability of firms using the inundated property, and the finances of state and local governments facing declining property tax revenues and rising remediation costs.

With perfect information and no externalities, the price of real estate-linked assets might already reflect these climate-related risks. However, given the uncertainty of climate and financial models and the potential opacity of climate-related exposures – a financial system vulnerability – investors in such real estate-linked assets may react abruptly to new information about a region's exposure to climate-related risks. 19 A sharp repricing shock, in turn, could create risks to financial stability through losses to leveraged financial intermediaries. 20

| Climate Risks | Economic Risks | Financial Risks | Financial Stability Risks | |

|---|---|---|---|---|

| Real Estate | Rising sea levels, frequency of storm surges | Increased inundation of coastal parcels | Decreased value of coastal real estate | Abrupt repricing of mortgage lending markets |

| Insurance | More frequent and severe hurricanes, wildfires, etc. | Greater disruption to local economic activity | Pressure for higher rates, lower supply of insurance and reinsurance | Greater uninsured losses, spillover effects |

Insurance markets: Under many scenarios, climate change also increases the frequency and severity of natural disasters such as wildfires and major storms. 21 These disasters, in turn, could damage physical assets and create growing disruptions to local economic activity, raising the cost of insuring highly exposed properties and businesses. As a result, the price of that coverage would rise, and insurers' willingness to offer policies on some properties would fall. The risk of business defaults following natural disasters could increase as firms tend towards lower levels of insurance coverage. This pullback in insurance coverage could be a financial system vulnerability with a variety of second-order effects, many of which are beginning to be visible in the property and casualty insurance markets of some states. 22

If states cap rate increases at levels insurers believe are too low, insurers may threaten to withdraw from those states entirely, leading those insurance markets to break down. If businesses are unable to secure coverage for critical functions, they could potentially cease certain services, with implications for the broader local economy. Similarly, households may be unable to obtain insurance on properties at reasonable cost, which could result in household migration to other locations.

With less private insurance and the potential for broader negative impacts on local economies, state and local governments could face pressure to provide coverage or absorb losses for areas affected by natural disasters. Coupled with a potential reduction in the tax base from emigration, governments could face increasing fiscal pressures and become less able to service their debt. This reduced ability to service debt could result in a higher probability of municipal bond defaults and knock-on consequences for municipal debt markets broadly. 23

Uncertainty also presents the possibility that insurance and reinsurance models will underestimate risk, another potential financial system vulnerability. As many insurers use standardized catastrophe models to help price risks, there is the potential for correlated losses if these models fail to reflect new patterns of weather and disasters. This could lead to a sudden repricing of many insurance products, leading to externalities for businesses and households that need to purchase coverage.

In principle, quantifying climate-related risks should be similar to quantifying other financial stability risks. In practice, however, climate-related risks face several challenges to measurement beyond those associated with conventional financial system vulnerabilities and potential shocks, and which will require investment to address. These climate-related features impair not only estimation and modeling at the level of the overall economy, but also the analysis of region-, sector-, asset-, institution-, and investor-level exposures. Investment in data procurement, and careful analysis of climate-related data to describe specific economic and financial risks, is critical to addressing these challenges and producing high-quality research on climate-related outcomes.

A fundamental challenge relates to merging and cleaning climate-related data for use in economic models. 24 Availability of sufficiently granular spatiotemporal and climate-related financial data is limited, including information on exposure to physical hazards or the emission levels of activities associated with particular investments or financial institutions. Investors or researchers hoping to assess the financial impacts of climate-related risks must often use proxies involving spatiotemporal weather data. Weather data collection is uneven across countries, making comparable assessments of climate-related risks from one data set alone difficult. Because these data sources are often partial, multiple data sources are often necessary to examine a specific climate-related financial risk.

Models that seek to link climate directly to economic output involve a separate set of challenges. Climate models typically simulate the interaction of a wide range of variables over many decades. In addition, the effects of climate change on economic activity may involve heterogeneous local or regional effects. These factors introduce uncertainty into even short- and medium-term projections, making aggregate climate models an imprecise source of information for near-term economic estimates and risk assessment. 25 , 26

Other modelling challenges include estimation of the effects of efforts to mitigate the physical effects of climate change. Mitigation efforts to reduce physical risks may have a long delay between implementation and the full effects; governments incur mitigation costs up front, but realize the benefits from mitigation gradually over time. Different economies, geographies, and sectors are also likely to face distinct risks from climate change, each taking actions that affect one another. Climate models can be insufficiently granular to support conclusions about these jurisdiction-specific impacts and their interactions, and historical weather data may not accurately reflect economic impacts under a new climate regime.

A final set of challenges are essentially logistical. Although the public sector generates a range of weather and climate data, much of that data resides across agencies and jurisdictions, leaving researchers to clean, process, and merge the data separately and independently. Once a data set is complete, analysis may be especially computationally intensive, requiring expertise and resources beyond the reach of many smaller research institutions. Several private firms have launched services to fill this gap, focusing on geographic exposures to more severe weather events, but generally remain available only to those who purchase them.

These challenges impede understanding of the linkages among climate, economic, financial, and financial stability risks described above (see also Fig. 1 and Fig. 2). They also have consequences for financial markets, as investors and institutions seek to incorporate climate change into pricing, investment, and risk management decisions.

This Note describes examples of financial stability risks arising from climate change, and how these risks can emerge as either shocks or vulnerabilities in the Federal Reserve's financial stability monitoring framework used in the Federal Reserve's Financial Stability Reports. Research to better understand the financial and financial stability risks of climate change continues to grow rapidly. More specifically, deeper analysis of the specific channels by which climate-related risks create hidden vulnerabilities in the financial sector will be an especially important topic for exploration. Continued research investments in this area will require a broad range of research and modelling approaches and tools and new sources of data. We believe these investments over time will increase policymakers' ability to monitor the relationship between climate change and financial stability.

Adrian, Tobias, Daniel Covitz, and Nellie Liang (2015). "Financial Stability Monitoring," Annual Review of Financial Economics, vol. 7 (1), pp. 357–95.

Alok, Shashwat, Nitin Kumar, and Russ Wermers (2020). "Do Fund Managers Misestimate Climate Disaster Risk?" Review of Financial Studies, vol. 33 (March), pp. 1146–83.

Amante, Christopher J. (2019). "Uncertain Seas: Probabilistic Modeling of Future Coastal Flood Zones," International Journal of Geographical Information Science, vol. 33 (July), pp. 2188–217.

Anderegg, William R.L., James W. Prall, Jacob Harold, and Stephen H. Schneider (2010). "Expert Credibility in Climate Change," PNAS, vol. 107 (July), pp. 12107–09.

Auffhammer, Maximilian (2018). "Quantifying Economic Damages from Climate Change," Journal of Economic Perspectives, vol. 32 (Fall), pp. 33–52.

Auffhammer, Maximilian, Solomon M. Hsiang, Wolfram Schlenker, and Adam Sobel (2013). "Using Weather Data and Climate Model Output in Economic Analyses of Climate Change," Review of Environmental Economics and Policy, vol. 7 (Summer), 181–98.

Board of Governors of the Federal Reserve System (2020). Financial Stability Report. Washington: Board of Governors, November, pp. 58–59, https://www.federalreserve.gov/publications/files/financial-stability-report-20201109.pdf (PDF).

Cai, Yongyang, and Thomas S. Lontzek (2019). "The Social Cost of Carbon with Economic and Climate Risks," Journal of Political Economy, vol. 127 (December), pp. 2684–734.

Carney, Mark (2015). "Breaking the Tragedy of the Horizon—Climate Change and Financial Stability," speech delivered at Lloyd's of London, London, September 29, https://www.bis.org/review/r151009a.pdf (PDF).

Fiedler, Tanya, Andy J. Pitman, Kate Mackenzie, Nick Wood, Christian Jakob, and Sarah E. Perkins-Kirkpatrick (2021). "Business Risk and the Emergence of Climate Analytics," Nature Climate Change, vol. 11 (February), pp. 87–94.

Financial Stability Board, Task Force on Climate-Related Financial Disclosures (2020). 2020 Status Report. Basel, Switzerland: FSB, October, https://assets.bbhub.io/company/sites/60/2020/09/2020-TCFD_Status-Report.pdf (PDF).

Flavelle, Christopher (2019a). "As Wildfires Get Worse, Insurers Pull Back from Riskiest Areas," New York Times, August 20.

Hong, Harrison, Frank Weikai Li, and Jiangmin Xu (2019). "Climate Risks and Market Efficiency," Journal of Econometrics, vol. 208 (January), pp. 265–81.

Hsiang, Solomon, and Robert E. Kopp (2018). "An Economist's Guide to Climate Change Science," Journal of Economic Perspectives, vol. 32 (Fall), pp. 3–32.

Hsiang, Solomon, Robert Kopp, Amir Jina, James Rising, Michael Delgado, Shashank Mohan, D.J. Rasmussen, Robert Muir-Wood, Paul Wilson, Michael Oppenheimer, Kate Larsen, and Trevor Hauser (2017). "Estimating Economic Damage from Climate Change in the United States," Science, vol. 356 (June), pp. 1362–69.

Intergovernmental Panel on Climate Change (2015). Climate Change 2014: Synthesis Report, Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Geneva: IPCC, https://www.ipcc.ch/site/assets/uploads/2018/02/SYR_AR5_FINAL_full.pdf (PDF).

——— (2018). Special Report: Global Warming of 1.5 ˚C. Geneva: IPCC, https://www.ipcc.ch/sr15.

Lenton, Timothy M., Hermann Held, and Elmar Kriegler (2008). "Tipping Elements in the Earth's Climate System," PNAS, vol. 105 (February), pp. 1786–93.

Lorenz, Edward N. (1963). "Deterministic Nonperiodic Flow," Journal of the Atmospheric Sciences, vol. 20 (March), pp. 130–41.

Moore, Frances C., and Delavane B. Diaz (2015). "Temperature Impacts on Economic Growth Warrant Stringent Mitigation Policy," Nature Climate Change, vol. 5 (January), pp. 127–31.

National Oceanic and Atmospheric Administration, Center for Operational Oceanographic Products and Services (2017). Global and Regional Sea Level Rise Scenarios for the United States, Technical Report NOS CO-OPS 083. Silver Spring, Md.: NOAA, January, https://tidesandcurrents.noaa.gov/publications/techrpt83_Global_and_Regional_SLR_Scenarios_for_the_US_final.pdf (PDF).

Network for Greening the Financial System (2019). Macroeconomic and Financial Stability: Implications of Climate Change, NGFS technical supplement to the first comprehensive report. Paris: NGFS Secretariat/Banque de France, July, https://www.ngfs.net/sites/default/files/medias/documents/ngfs-report-technical-supplement_final_v2.pdf (PDF).

Nordhaus, William D. (1977). "Economic Growth and Climate: The Carbon Dioxide Problem," American Economic Review, vol. 67 (February), pp. 341–46.

——— (1991). "To Slow or Not to Slow: The Economics of the Greenhouse Effect," Economic Journal, vol. 101 (July), pp. 920–37.

——— (1992). "An Optimal Transition Path for Controlling Greenhouse Gases," Science, vol. 258 (November), pp. 1315–19.

——— (2017). "Revisiting the Social Cost of Carbon," PNAS, vol. 114 (February), pp. 1518–23.

Norton, Leslie P. (2019). "Muni Bonds Face Climate Change. And Investors Are Ignoring the Risks," Barron's, September 20. https://www.barrons.com/articles/muni-bonds-face-climate-change-and-investors-are-ignoring-the-risks-51569010788

Ouazad, Amine, and Matthew A. Kahn (2019). "Mortgage Finance in the Face of Rising Climate Risk," NBER Working Paper Series 26322. Cambridge, Mass.: National Bureau of Economic Research, September, https://www.nber.org/system/files/working_papers/w26322/revisions/w26322.rev0.pdf (PDF).

Rhodium Group (Accessed September 21, 2020). "Climate Risk: Actionable, Asset-Level Data and Analysis," webpage on Climate Risk Service, https://rhg.com/data_story/climate-risk-service.

——— (2019). Clear, Present and Underpriced: The Physical Risks of Climate Change. New York: Rhodium Group, April, https://rhg.com/research/physical-risks-climate-blackrock.

Rodziewicz, David, Christopher J. Amante, Jacob Dice, and Eugene Wahl (2020). "Housing Market Value Impairment from Future Sea-Level Rise Inundation," Research Working Paper Series RWP 20-05. Kansas City: Federal Reserve Bank of Kansas City, July, https://www.kansascityfed.org/research/research-working-papers/housing-market-value-impairment.

Rudebusch, Glenn D. (2019). "Climate Change and the Federal Reserve," FRBSF Economic Letter 2019-09. San Francisco: Federal Reserve Bank of San Francisco, March, https://www.frbsf.org/economic-research/publications/economic-letter/2019/march/climate-change-and-federal-reserve.

——— (2021). "Climate Change Is a Source of Financial Risk," FRBSF Economic Letter 2021-03. San Francisco: Federal Reserve Bank of San Francisco, February, https://www.frbsf.org/economic-research/publications/economic-letter/2021/february/climate-change-is-source-of-financial-risk.

Sheehan, Matt (2020). "RenRe Could Pull Back in Florida If Rates Stay Low, Says CEO," Reinsurance News, February 7.

Sorkin, Rich (2020). "Jupiter Intelligence: Predicting Risk in a Changing Climate," video. Honolulu: Elemental Excelerator, July 16, https://elementalexcelerator.com/latest/videos/jupiter-intelligence-predicting-risk-in-a-changing-climate.

Starks, Laura T., Parth Venkat, and Qifei Zhu (2017). "Corporate ESG Profiles and Investor Horizons," working paper, October.

Stern, Nicholas (2007). The Economics of Climate Change: The Stern Review. New York: Cambridge University Press.

Tett, Gillian (2020). "Big Four Accounting Firms Unveil ESG Reporting Standards," Financial Times, September 22.

U.S. Global Change Research Program (2018). Fourth National Climate Assessment. Washington: USGCRP, November, https://nca2018.globalchange.gov/downloads/NCA4_2018_FullReport.pdf (PDF).

van den Bergh, J.C.J.M., and W.J.W. Botzen (2014). "A Lower Bound to the Social Cost of CO2 Emissions," Nature Climate Change, vol. 4 (March), pp. 253–58.

*Federal Reserve Bank of New York

**Federal Reserve Bank of Chicago

1. Among public organizations, this includes efforts by the Financial Stability Board, Basel Committee on Banking Supervision, International Association of Insurance Supervisors, International Organization of Securities Commissioners, United Nations Environment Programme, Network for Greening the Financial System, and Commodity Futures Trading Commission, as well as central banks, including recently the Federal Reserve Board (see Board of Governors (2020)). In addition, there has been substantial private sector, nongovernmental organization (NGO), think tank, Congressional, media, and research attention. Return to text

2. See, e.g., Rudebusch (2019) and (2021). Return to text

3. See Board of Governors (2020) and Adrian, Covitz, and Liang (2015). Return to text

4. A related box on the financial stability implications of climate change appears in the Federal Reserve Board's November 2020 Financial Stability Report. Return to text

5. Material in this section is adapted from Hsiang and Kopp (2018). Return to text

6. See, e.g., Intergovernmental Panel on Climate Change (2015a,b); Anderegg et al. (2010). Return to text

7. See also Hsiang et al. (2017) on the role of economic projections as a main source of uncertainty in climate models. Return to text

8. See, e.g., Nordhaus (1977), (1991), and (1992). Return to text

9. See, e.g., U.S. Global Change Research Program (2017), chapters 10, 11, 12 (PDF), and 14 (PDF). Return to text

10. See Adrian et al. (2015). Return to text

11. See, e.g., Rhodium Group (2019) and (2020). Return to text

12. See Adrian et al. (2015), pp. 388-89 (relating vulnerabilities and systemic risk to "data collections" and "accounting standards"). Return to text

13. The Big Four U.S. accounting firms and the World Economic Forum recently released a reporting framework for environmental, social and governance (ESG) standards; see Tett (2020). Return to text

14. See, e.g., FSB Task Force on Climate-Related Financial Disclosures (2020), p. 8 ("Disclosure [of climate-related financial information] increased, on average, across the 11 recommended disclosures by six percentage points between 2017 and 2019. However, companies' disclosure of the potential financial impact of climate change on their businesses, strategies, and financial planning is low"). In September 2020, the International Financial Reporting Standards (IFRS) Trustees published a consultation paper on sustainability reporting to determine whether there is a need for global sustainability standards, whether the IFRS Foundation should play a role, and what the scope of that role could be; comments were due by December 31, 2020. Return to text

15. Hong et al. (2019) find long-run stock market inefficiency with respect to pricing of drought severity. Return to text

16. See Cai and Lontzek (2019), who note that the integrated assessment models (IAM) literature has recently studied the importance of climate tipping points, which refer to 'a critical threshold at which a tiny perturbation can qualitatively alter the state or development of [the climate] system,' and tipping elements, which are 'large-scale components of the Earth system that may pass a tipping point' (definitions from Lenton et al. 2008, p. 1786). A key feature of a tipping element is that current temperature affects the likelihood of a tipping event that results in a transition to an irreversible "tipping process." Examples of tipping processes include the melting of the Greenland or West Antarctic ice sheets. See also IPCC 2018, section 3.5. Return to text

17. See, e.g., Sweet et al. (2017); Amante (2019). Return to text

18. See, e.g., Rodziewicz et al. (2020). Return to text

19. See, e.g., Alok et al. (2020). Return to text

20. See, e.g., Ouazad and Kahn (2019). Return to text

21. See Intergovernmental Panel on Climate Change (2015a) ("A changing climate leads to changes in the frequency, intensity, spatial extent, duration, and timing of weather and climate extremes, and can result in unprecedented extremes"). Return to text

22. See, e.g., Flavelle (August 2019) and Sheehan (2020). Return to text

24. Where not otherwise cited in this section, see Auffhammer et al. (2013); Auffhammer (2018); Network for Greening the Financial System (2019). Return to text

25. For a summary of estimates of the effects of climate change on economic growth, see, e.g., Network for Greening the Financial System (2019) and Hsiang et al. (2017). For estimates of social cost of carbon emissions, see, e.g., Nordhaus (2017), van den Bergh and Botzen (2014), and Moore and Diaz (2015). Return to text

26. For an overview of the current limitations of climate models for use in financial risk assessments performed at spatial and temporal scales smaller than continental or multi-decadal, see, e.g., Fiedler et al. (2021). Return to text

Please cite this note as:Brunetti, Celso, Benjamin Dennis, Dylan Gates, Diana Hancock, David Ignell, Elizabeth K. Kiser, Gurubala Kotta, Anna Kovner, Richard J. Rosen, and Nicholas K. Tabor (2021). "Climate Change and Financial Stability," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, March 19, 2021, https://doi.org/10.17016/2380-7172.2893.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.